Mid-Year Investing Outlook: How the Market Looks Now

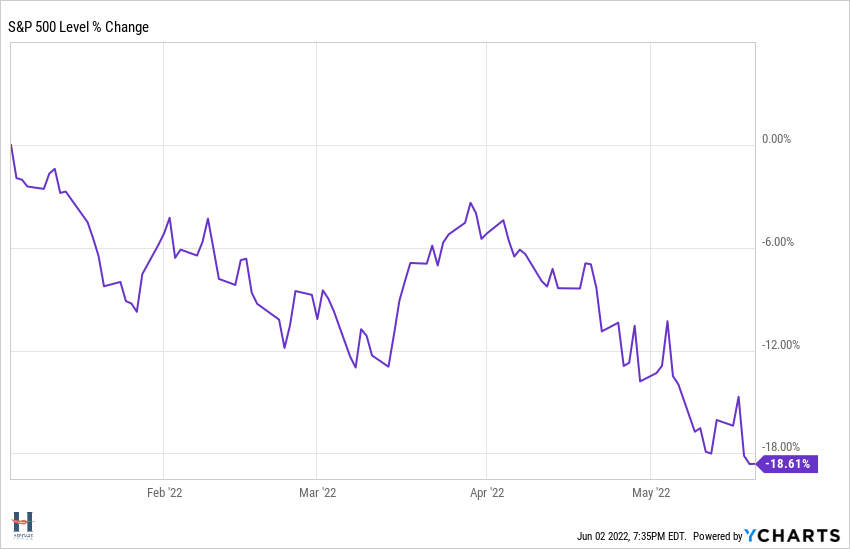

The S&P 500 flirted with bear market territory two weeks ago.

Its intra day low on May 20th was 21% below the year’s high set on January 4th. However, it came back that day and closed 18.61% from the peak.

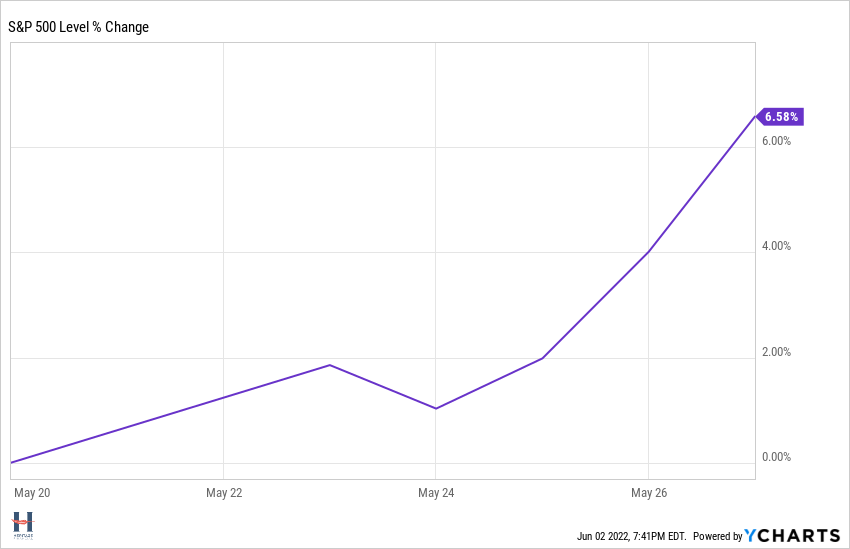

The next week we had some optimism around inflation, and the market bounced 6%.

Welcome to investing in the first half of 2022

Volatility √.

Recession fears √.

War √.

High inflation √.

Bond and stock market weakness √.

Fun times for investors wondering what to do with their portfolios. Cashing out and “waiting for things to get better” isn’t an option. It’s a recipe for selling low and buying high later.

So, what better time to hear from a Chief Investment Officer who leads an investment team tasked with managing over $2 billion for individual investors?

In our latest Wealthy Behavior podcast, episode my colleague, Bob Weisse, shared his mid-year investing outlook.

The highlights:

- Inflation continues to be the story driving markets

- Inflation-sensitive assets are performing well this year

- Stocks are cheaper now, which makes stocks more attractive

- Bond yields are higher now, which makes bonds more attractive (Don’t Bail on Your Bonds)

- Optimism that we may have reached peak inflation, and the reality that inflation-sensitive assets have performed well, make it a good time to consider rebalancing by trimming inflation-sensitive assets and buying stocks and bonds

- The inflation-sensitive assets he likes most are real estate, infrastructure, farmland, and timber

- A recession and further market downturns are very much on the table. The macro picture is always cloudy, and Bob’s mid-year investing outlook focuses on investment valuations and not economic predictions.

Be sure to listen to the whole episode as Bob also discusses why he doesn’t like TIPS, why it’s important to be a global investor, why international markets are attractive now, the impact of the Ukraine War, and even why he’s happy he owns an electric car and solar panels (An Investment Guy’s Review of Solar Panels).

Episode 6: Is the worst behind us for stocks or is this a good entry point?

Available through the link in title.

Further Reading:

Why to Watch (and not fight) the Fed