This Month’s Market Volatility

The market volatility we saw last week, which has been threatening in fits and starts since the S&P 500 made an all-time high on January 4th, continued yesterday although the market fought back from a big loss to end the day positive.

I have some thoughts about what’s going on even though long-time readers with good portfolios know you shouldn’t react to this stuff.

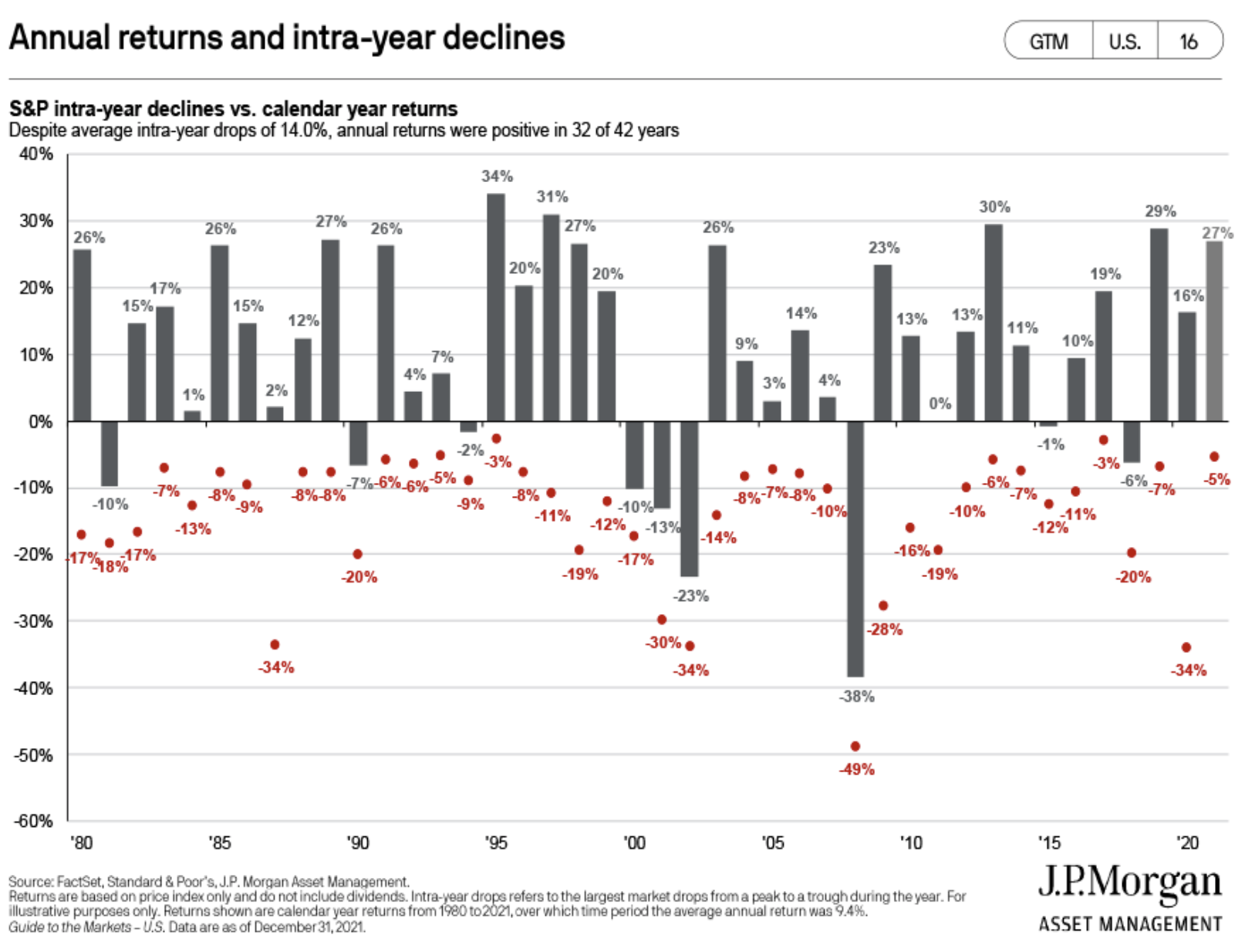

Market volatility is normal. We average a 14% intra-year decline going back 40 plus years. Registering only a 5% decline last year was the surprise, not that we’re staring off this year with a larger one.

Frothier Stocks and Sectors are Leading the Sell-Off

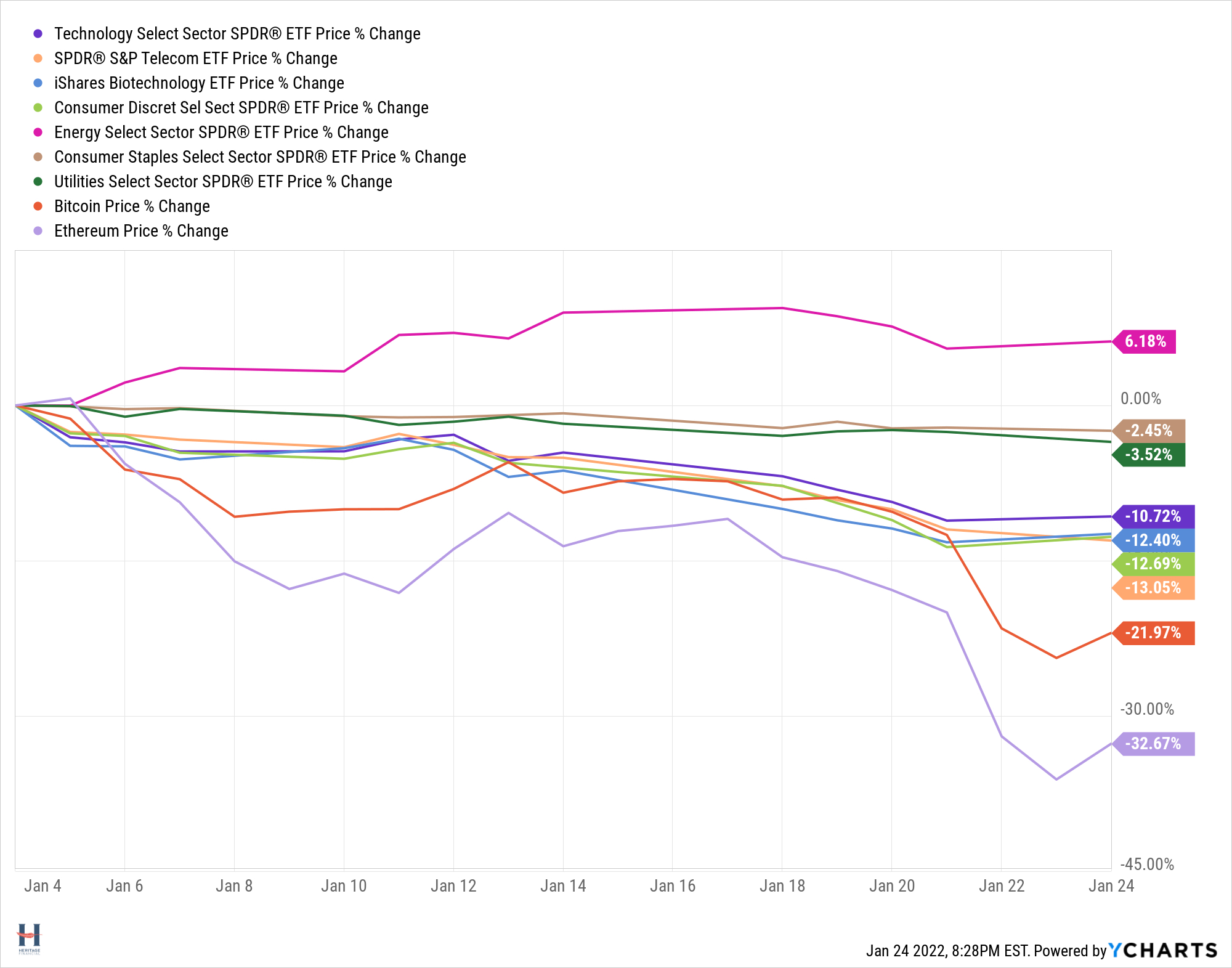

Some stocks are getting hit harder than others. Expensive stuff seems to be quickly repricing and frothier areas of the market are struggling more.

- The S&P 500 is down less than 8% from its peak. Technology, Telecom, Biotech, and the Consumer Discretionary sectors (as represented by these Sector ETFs) are down more.

- Energy, Consumer Staples, and Utilities are doing much better.

- Crypto is getting killed (sorry, couldn’t resist).

Price matters

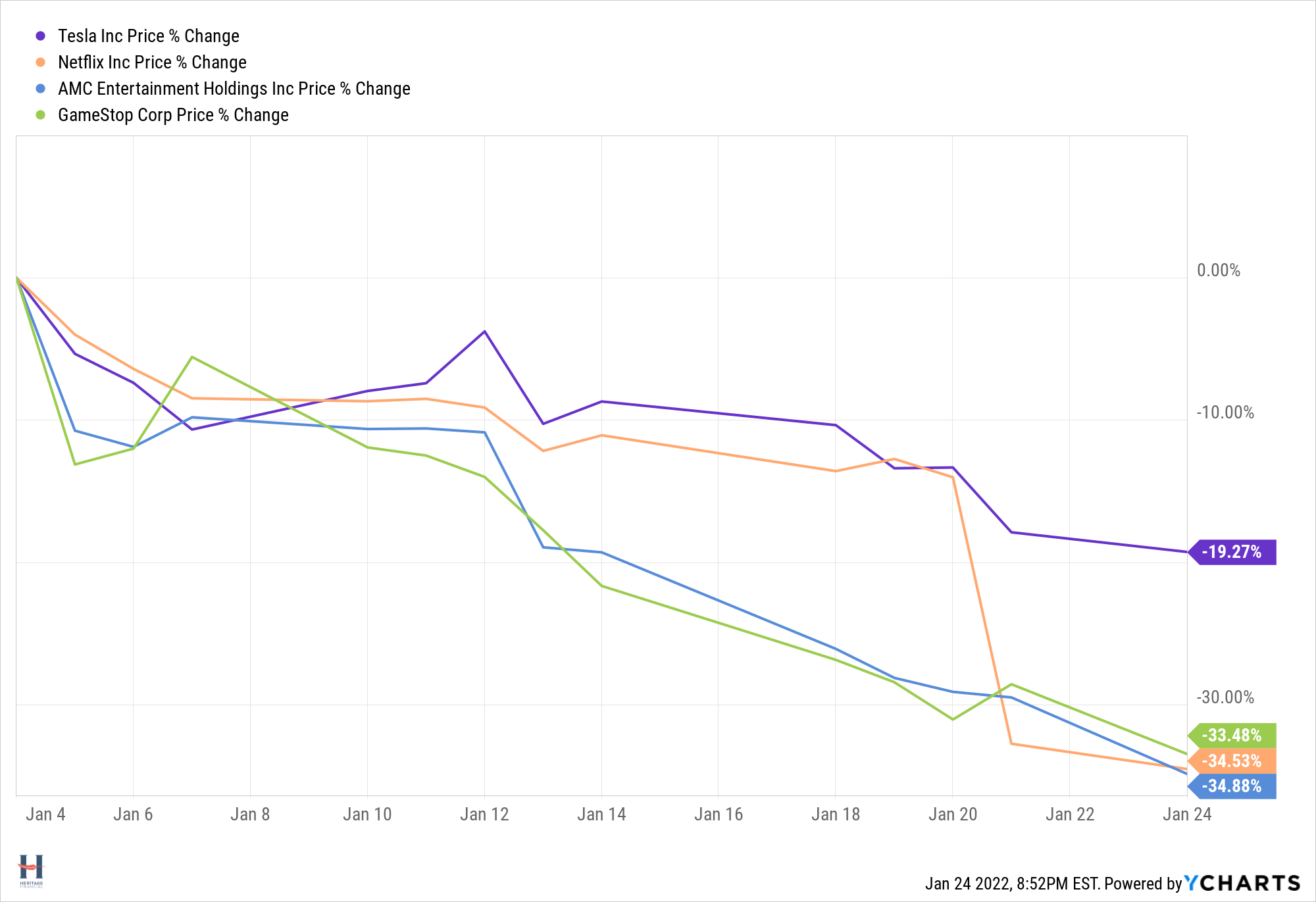

It hasn’t seemed like that recently with the speculative meme stocks and high-flying names people have continued to buy.

Here’s how some have fared since January 4th. Short sellers are up $114 billion this year with winning bets against Tesla and Netflix.

As investors we know price matters when making an investment, but we don’t always know when it will.

If you own these expensive stocks and sectors, don’t sit there paralyzed thinking it’s too late to reduce risk or fret over taxes. Make portfolio adjustments. Get out of speculative stuff. Trim your expensive winners. Rotate into cheaper stocks.

If you never had a plan to begin with and were just chasing winners, stop and get some advice.

Some Asset Classes are Doing Better than Others

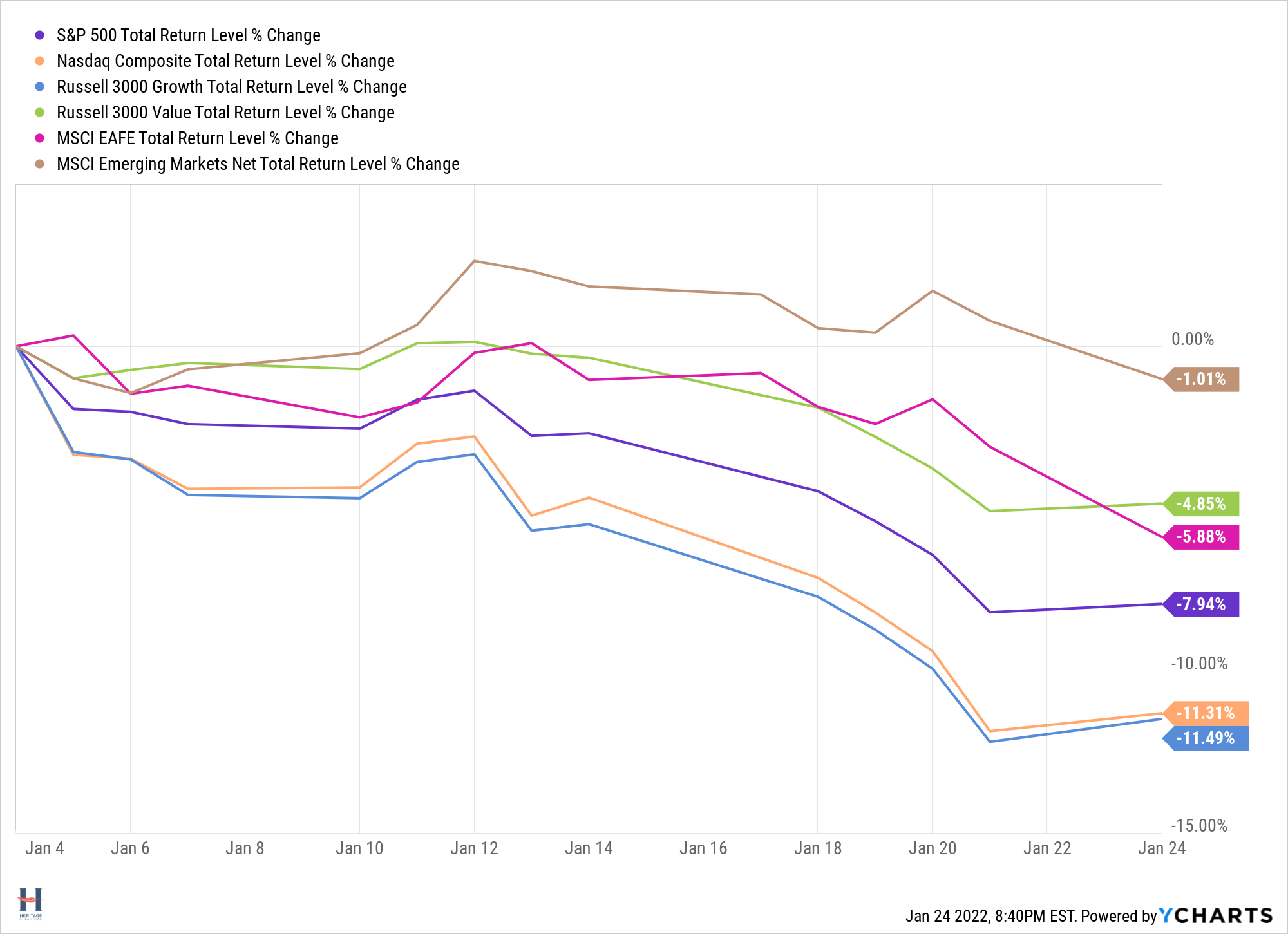

Growth stocks (Russell 3000 Growth) and the tech-heavy Nasdaq are down more than the S&P 500 – down 11.5% and 11.3% respectively.

Value stocks (Russell 3000 Value) are doing better – down 4.9%.

Developed international stocks (MSCI EAFE) and Emerging Markets stocks (MSCI Emerging Markets) are also doing well by comparison to the S&P 500, continuing a market shift I first wrote about in The Reopening Trade Continues.

Diversification matters

If you’re not picking individual stocks, but instead asset allocating to build a portfolio and your portfolio is dominated by U.S. large cap growth stocks, make shifts into international equities and value stocks and follow the guidance in our 2022 Investment Outlook.

Long-term investors need to own stocks. You don’t always need to own the top-performing index, particularly as it gets more expensive.

Diversify. It’ll help you at some point. The biggest downside to diversification is FOMO. An investor in a diversified portfolio will always be able to point to things they should have owned more of along the way. We can’t predict short-term winners and losers, but over the long-run (and that is not 2-3 years) diversification works.

Investor Performance is More Important than Investment Performance

Cue the obligatory market volatility lecture…

This isn’t much of a decline, but it’s the first one we’ve had in over a year. It seems different because they all feel different.

The Fed is going to raise rates and clobber the market.

Inflation is out of control and everyone’s lying about it.

COVID – Well, let’s just say you can take that one in any direction and people have.

Stay invested.

Stick to your plan. The market rewards long-term and patient investors.

Your portfolio wasn’t built with the idea that we would never face market corrections or worse. The market has known for a long-time that the Fed was going to tighten its monetary policy. Ditto with the inflation knowledge.

And for goodness sake’s ask for help if you need it. Investment mistakes are significantly more expensive and painful than paying a reasonable fee to a professional advisor.

Concerned about Your Portfolio?

Suggested Further Reading

Protecting Your Portfolio From a Bear Market

Why to Watch (and not fight) the Fed

How Long to Give an Investment Strategy