Checking in on This Bull Market

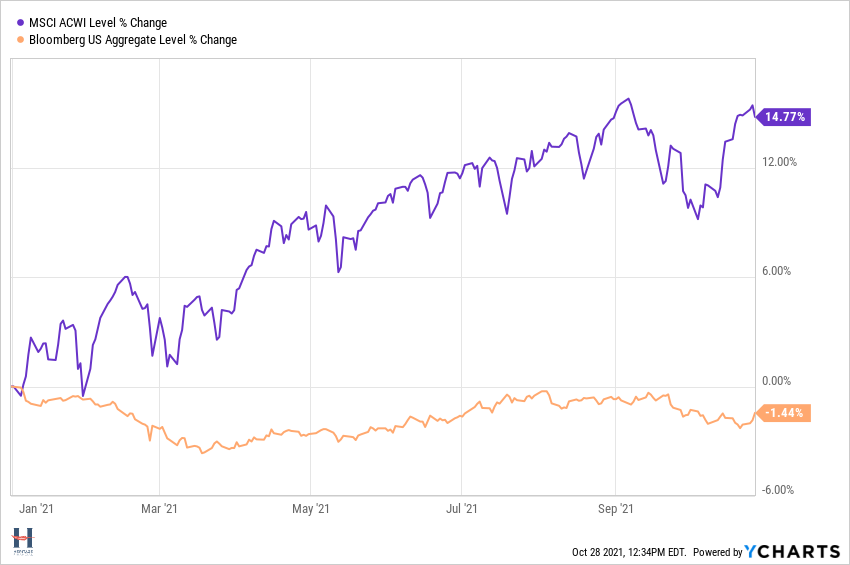

Stocks are up this year. Bonds have struggled. Real assets have done well.

And there’s been minimal volatility for investors to navigate. The largest drop in global stocks so far this year was just over 6% and the market quickly rebounded.

Good stuff.

But you can get into a strange habit of looking at markets only through the random lens of calendar year returns.

As the big guy himself one wrote to his investors:

Our investments are simply not aware that it takes 356 – 1/4 days for the earth to make it around the sun. Even worse, they are not aware that your celestial orientation (and that of the IRS) requires that I report to you upon the conclusion of each orbit (the Earth’s – not ours). Therefore, we have to use a standard other than the calendar to measure our progress.

Warren Buffett Partnership Letter – July 12, 1966

The Current Bull

This bull market was born in March of 2020 coming off the fastest 30% decline ever.

During the decline, I wrote in What We’re Telling Clients that the market will rebound, the economy will improve after the market does so you can’t use economic data as a signal for when to get back in, and it’s important to have a good investment strategy in place that may even have you buying more stocks if the decline gets large enough.

I elaborated on this and explained the two ways you can rebalance in 3 Things Investors Should Know Now.

Fortunately, the market did recover and the optimism wasn’t misplaced. The recovery was so quick it left investors thinking the market did not make ANY sense. I tried to explain in This Market is NOT Crazy why the market recovered before the economy.

Then as things calmed down, there was time to reflect on the lessons learned from the longest bull market ever in R.I.P. 2009 – 2020 Bull Market & Lessons Learned.

One investment lesson is that Investment Winners Rotate. The leaders of the past can be the laggards of tomorrow. Therefore, six months into the bull market I shared some Portfolio Changes to Consider Now.

Now that this bull market is getting longer in the tooth and we have new concerns like whether we should be Worrying About Inflation and what to do about it if you are, what’s next for this recovery and bull market?

That’s the focus of my upcoming webinar with two investment greats – Bob Weisse, Chief Investment Officer of Heritage Financial, and Brad Long, Research Director – Global Public Markets for Fiducient Advisors.

Join us on November 9, 2021 11:30 a.m. – 12:30 p.m. as we discuss whether stocks can keep climbing after double-digit gains thus far despite concerns about inflation, Federal Reserve tightening, problems with Chinese stocks, and the potential for tax hikes.

What’s Next for the Recovery and Bull Market?

Join us and find out